personal loan sbi, personal loan interest rates in sbi, personal loan sbi interest rate, personal loan sbi rate of interest, personal loan sbi emi calculator, best personal loan in India, apply personal loan online, @sbi.com

|

| Download loan form |

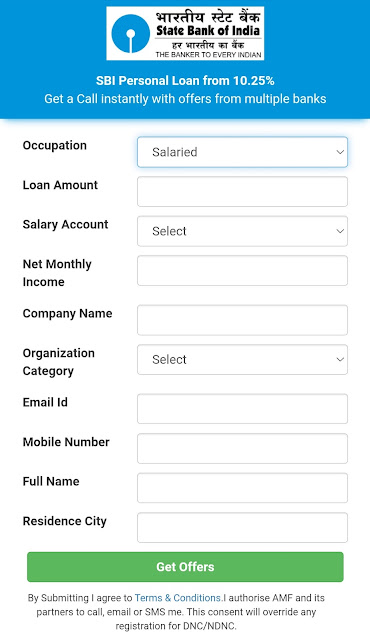

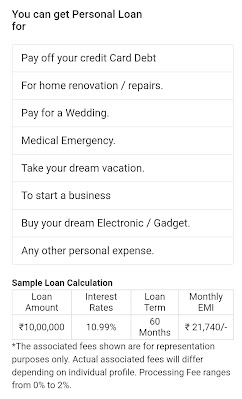

If you have any money need that you want to fulfil and want to take it from a government bank then SBI is the name. For people working in government companies multiple special offers are available with low interest rates. The foreclosure charges with SBI are also very less. The process usually is not fast and disbursements take more than 4 days. An individual can get up to 15 times of his salary. The processing fees and other charges are as per what other banks charge. SBI Personal Loan has tenure from 1-5 years are also available. Flexible payments of EMI are also available.

Interest rate for Xpress CreditTerm Loan is starting from 11.45%pa to 13.45%pa. Interest Rate for Xpress Credit Overdraft Facility is starting from 11.95%pa to 14.45%pa. Processing fees will be 1% of loan amount and Prepayment charges will be 3% on the prepaid amount. 2%pa will be the penal interest. Customer has a duration of 5 years to repay the loan amount.

b)XPRESS POWER LOAN - This is an unsecured loan to the salaried employees who is not having their salary account with sbi.Individual can get loan upto 15lakhs.Individuals monthly net income should be minimum of Rs 50,000 to avail this scheme. Customer can avail this scheme anytime to fulfill your personal requirements.

Xpress Power Loan also having Term Loan and Overdraft Facility.

Interest Rate for Xpress Power Term Loan facility is 8.10% for 2 years MCLR thereafter 3.50% to 5.15% for spread over 2 year MCLR and effective interest rate of 11.60% to 13.25% with no reset.Interest Rate for Xpress Power Loan Overdraft Facility is same 8.10% for 2 years MCLR thereafter 4.00% to 5.65% for spread over 2 year MCLR and effective interest rate of 12.10% to 13.75% with no reset.Processing fees will be 1% of loan amount and Prepayment charges will be 3% on the prepaid amount. 2%pa will be penal interest.

c)SBI PENSION PLAN- This scheme is given to the customers to meet their sudden and unexpected funds.Pensioners age should be upto 76 years to avail this scheme.customers pension payment order be maintained by our bank.Individual can get loan upto Rs 15lakhs.Following scheme is only for central and state govrnment employees. SBI Pension loan also having term loan and overdraft facility.

Interest rate for SBI Pension Plan Term Loan facility is 11.45% onwards and 11.95% onwards for overdraft facility.Processing fees will be % of loan amount and Prepayment charges will be 3% on the prepaid amount.There is no extra penal interest.

SCHEME FOR PRE-APPROVED CUSTOMER BY SBI-

FOR SALARIED CUSTOMER AN PENSIONERS- Ths scheme is available for customer who is pre-selected by SBI who is maintaining a good amount of salary package and pension amount with us.Customer can appy for such loan through YONO App anytime and anywhere in their convenient time.Customer are not required to submit physical documents.Low processing fees with no hidden charges.Customer gets loan instantly.

FOR NON-SALARIED CUSTOMER- This scheme is available for customer who is having their salary account with other banks but having account with regular money depositing /maintaining average monthly balance with SBI are selected by SBI. Customer can avail loan upto Rs2lakhs through YONO app anytime and anywhere in their convenient time.No physical Documentation.

DIFFERENT TYPES OF PERSONAL LOAN OFFERED BY SBI

a)XPRESS CREDIT PERSONAL LOAN- This scheme is offered for the individuals who is planning a wedding or a vacation, or planning to purchase a big-ticket.Individuals can take this loan to meet their urgent financial requirements.Loan amount can go upto 20lakhs. Interest rates varies according to the individual starting from 11.50%pa to 12%pa.This scheme is only provided to the salaried customers who is having their salary account with sbi.Individual can get loan amount upto 20lakhs.Minimum salary should be Rs 15,000. Xpress Credit Personal loan is having Term Loan and Overdraft Facility as well.Interest rate for Xpress CreditTerm Loan is starting from 11.45%pa to 13.45%pa. Interest Rate for Xpress Credit Overdraft Facility is starting from 11.95%pa to 14.45%pa. Processing fees will be 1% of loan amount and Prepayment charges will be 3% on the prepaid amount. 2%pa will be the penal interest. Customer has a duration of 5 years to repay the loan amount.

b)XPRESS POWER LOAN - This is an unsecured loan to the salaried employees who is not having their salary account with sbi.Individual can get loan upto 15lakhs.Individuals monthly net income should be minimum of Rs 50,000 to avail this scheme. Customer can avail this scheme anytime to fulfill your personal requirements.

Xpress Power Loan also having Term Loan and Overdraft Facility.

Interest Rate for Xpress Power Term Loan facility is 8.10% for 2 years MCLR thereafter 3.50% to 5.15% for spread over 2 year MCLR and effective interest rate of 11.60% to 13.25% with no reset.Interest Rate for Xpress Power Loan Overdraft Facility is same 8.10% for 2 years MCLR thereafter 4.00% to 5.65% for spread over 2 year MCLR and effective interest rate of 12.10% to 13.75% with no reset.Processing fees will be 1% of loan amount and Prepayment charges will be 3% on the prepaid amount. 2%pa will be penal interest.

c)SBI PENSION PLAN- This scheme is given to the customers to meet their sudden and unexpected funds.Pensioners age should be upto 76 years to avail this scheme.customers pension payment order be maintained by our bank.Individual can get loan upto Rs 15lakhs.Following scheme is only for central and state govrnment employees. SBI Pension loan also having term loan and overdraft facility.

Interest rate for SBI Pension Plan Term Loan facility is 11.45% onwards and 11.95% onwards for overdraft facility.Processing fees will be % of loan amount and Prepayment charges will be 3% on the prepaid amount.There is no extra penal interest.

SCHEME FOR PRE-APPROVED CUSTOMER BY SBI-

FOR SALARIED CUSTOMER AN PENSIONERS- Ths scheme is available for customer who is pre-selected by SBI who is maintaining a good amount of salary package and pension amount with us.Customer can appy for such loan through YONO App anytime and anywhere in their convenient time.Customer are not required to submit physical documents.Low processing fees with no hidden charges.Customer gets loan instantly.

FOR NON-SALARIED CUSTOMER- This scheme is available for customer who is having their salary account with other banks but having account with regular money depositing /maintaining average monthly balance with SBI are selected by SBI. Customer can avail loan upto Rs2lakhs through YONO app anytime and anywhere in their convenient time.No physical Documentation.

Comments

Post a Comment